- No Commissions

- No news restrictions

- Static Drawdown

- 3-min rule is dangerous

- Lot size rule is ridiculous

- New prop firm, no established trust

When Funded Pro Trader hit our radar we got really excited. A broker that claims to have institutional spreads and zero commissions? What voodoo is this? FTP has some really attractive pros such as not restricting news, EAs, utilizing static drawdown, and zero commissions to name a few.

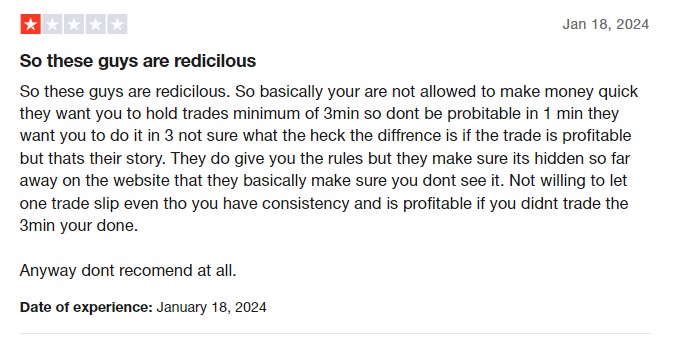

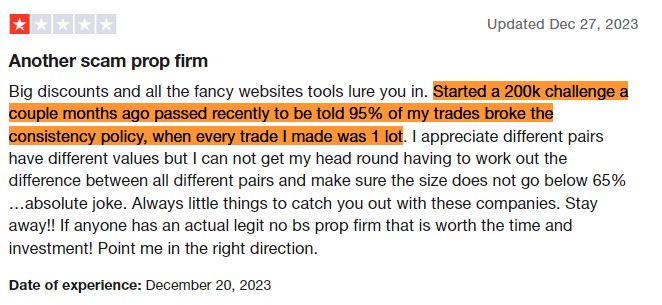

However, it may not be enough to outweigh some significant problems we have with them. Their website claims to offer “Straightforward and easy-to-follow trading rules.” However, we find this statement to be misleading. The negative reviews on TrustPilot primarily concern the 3-minute rule and the lot size rule. To be fair, these rules are mentioned in the FAQ on their website, so they are not entirely hidden. However, they are not prominently displayed either. While traders should be reading the FAQ, for those who haven’t, we have read it for you.

Concerns

- 3-minute rule – The Crypto Fund Trader had implemented a similar rule to The Funded Pro Trader, for their now defuncted zero commissions challenge. The main difference is that Crypto Fund Trader had a very fair grace window where 5% of your trades could “violate” the rule without you being terminated. The Funded Pro Trader has no such leniency, and any trade that closes before 3 minutes will result in account termination.

“Well, that isn’t a problem bro, I don’t scalp.” Think again, my friend. Suppose you enter a trade that would normally take hours or maybe days to play out, but suddenly it impulses and hits your stop-loss. “Oh well, no big deal, losses are part of trading,” you might think. Wrong, it is a very big deal! That loss, which was beyond your control, occurred within three minutes of entering the trade, therefore your account is terminated. - HFT trading – This concern also relates to the 3-minute rule. They claim to allow HFT, which stands for High Frequency Trading, essentially scalping on steroids. It’s impossible to allow HFT while simultaneously enforcing a minimum trade duration of three minutes. This inconsistency implies either a lack of understanding what HFT is or an intentional effort to mislead traders.

- Trade size rule – Often called a “consistency rule,” but we explain here why that is bs. Funded Pro Trader requires that your smallest trade in USD notional value not be lower than 65% of your highest trades in USD notional value. Although this rule might appear innocuous, it effectively corrals you into their restricted notion of what trading is. They label this as consistency, but in reality, it has nothing to do with actual consistency. My risk approach varies across different instruments, and in a prop fund account, if I’m down by several percent, I reduce my risk until I’m back in profit. Adhering to this rule would penalize such a strategy.

- Inconsistency in rules/FAQ – Under “Are there any limitations on the strategies and EA’s that I can use?” they state “FPT does not impose any restrictions on your trading style or strategy. Whether you prefer discretionary trading, hedging, algo trading, or any other approach, you are free to use it with FPT,” but then under the heading “What are the consequences if a rule is violated” on a funded account, they state “Using a prohibited trading strategy: the profit-sharing account will be terminated.” How can I use a prohibited strategy when there are none? They contradict themselves in their FAQ over 7 times. Several users have stated they were banned for hedging, so it is clearly a rule. Also, forcing traders to use a specific trade size is a trading strategy

One of these concerns might not raise alarm bells, but there are too many red flags. Also be aware that if you violate a rule during the challenge they will not tell you, they will allow you to continue both steps and then fail you.

The Funded Pro Trader Challenge

The Funded Pro Trader offers only one challenge, with six different funding options.

- Entry cost: $79 for $10k in funding. Challenge fee is refunded* upon passing, if you become eligible for a payout. Essentially, the challenge is free if you succeed

*Their FAQ states, “The initial withdrawal should cover the challenge fee, as it is refunded upon the first withdrawal.” This wording strongly implies that the “refund” is deducted from your own profits. - Challenge: Two-step program requiring 8% profit in step 1 and 5% profit in step 2, with max loss of 10% and max daily loss of 5%. Drawdown: Static 10% based on initial account balance

- Leverage: 1:100 (adjusted during “market volatility” which is unusual)

- Minimum of 5 Trading Days required to pass in each phase. FAQ does not specify if these have to be profitable days but we do know that you are not allowed to trade 0.1 lot size

- No time limit to complete challenge, take as long as you need

- News trading is allowed with no restrictions

- Weekend holding of trades is allowed but they adjust leverage over weekends which could cause overleveraging during volatility

- Stop loss is not required

- Scaling plan: None available

- Profit split: 90/10 of what the trader earns may be withdrawn as a profit split

Commissions and Spreads

The Funded Pro Trader uses ECG Broker

Spreads

We are currently attempting to test spreads for The Funded Pro Trader and will update this section asap. In our experience prop funds that offer zero commissions have exceptionally terrible spreads. We are not able to confirm this as of yet.

Average spreads during normal trading hours

| Pair | Avg. Spread | Lowest Spread | Highest Spread |

| EURUSD | |||

| GBPUSD | |||

| USDCHF | |||

| USDJPY |

Average Spreads from 4-6PM EST

| Pair | Avg. Spread | Lowest Spread | Highest Spread |

| EURUSD | |||

| GBPUSD | |||

| USDCHF | |||

| USDJPY | |||

| AUDUSD | |||

| EURJPY | |||

| GBPJPY |

Trading Commissions

- Forex: ZERO Commissions

- Metals: ZERO Commissions

- Indices: ZERO Commissions

- Crypto: ZERO Commissions

- Oil: ZERO Commissions

Prop Fund Fees

The Funded Pro Trader does not charge any fees apart from the evaluation/challenge cost. Because you can only withdraw in Crypto now, there are fees associated with the crypto withdrawal.

Payout

To date we have no valid record of any payouts from this prop fund. They claim to offer the trader 90% of what they make on a funded account.

Profit Withdrawal Limitations

First profit withdrawal must exceed the cost of your challenge. It sounds like this is your “refund” for the challenge, we are waiting to confirm if this is indeed true.

Verdict

The Funded Pro Trader had potential and might have earned out recommendation. However, their imposition of numerous questionable rules, inconsistency in clarifying these rules, and lack of established trust lead us to make the judgement that The Funded Pro Trader is a risky prop fund. They are highly likely to terminate your account and unlikely to payout any large payouts.