- None

- Many Hidden rules

- Inconsistent, vague, and even made-up rules

- Changing Lot Size Is Violation

- Large Payouts Always Denied

- Typical Eightcap “slippage”

- Reducing Loss May Terminate Account

- Drawdown is Dynamic Though They Claim it is Static

- No trust

Our reviews are based on a thorough investigation into how a prop fund works, their rules, their history of payouts, and often our own personal experience as we sign-up for most of the prop firms we review. One of the sneaky things that some prop firms do, is to mask a subset of rules under the heading of one seemingly innocuous rule, for the purpose to trick traders. This firm also utilizes similar strategies to MFF to refuse payouts to their traders.

Hidden Rules

It is unfortunate, but Smart Prop Trader seems to be trying to outsmart their traders. They have numerous hidden rules, such as the one regarding “Maximum Lot Size.” This rule is framed as though the limitation is leverage, which, with most honest prop firms, would trigger a cancelled order. However, Smart Prop Trader instead allows you to trade and make profit, then refuses to pay out, claiming you exceeded lot size. Furthermore, if you change lot size, you will be accused of using Martingale trading, which is crazy.

Martingale Reintrepreted

Smart Prop Trader has redefined the term “Martingale” and now uses it as a pretext for a variety of reasons to refuse payouts to their traders. One such rule, which is not listed in their FAQ but has been the basis for banning many traders, involves changing the lot size when trading the same pair. For example, if you trade 5 lots on EURUSD, are in profit, and then either close the trade or leave it open, and subsequently take another trade on EURUSD for 7 lots, Smart Prop Trader considers this “Martingale” trading.

Reverse Martingale Trading

While this may sound like a complex strategy to game the system, it is actually an effective risk management approach used by many successful traders, and causes no harm to the prop firm. Essentially, it works like this: when you have a losing trade, you risk only half as much on the next trade, but when you have a winning trade, you risk twice as much. This method decreases losses during losing streaks and increases profits during winning streaks. It may not be for everyone but it most certainly is not a high risk strategy.

Most prop firms prohibit trading Martingale, which makes sense because it is a strategy where you double your risk after every loss, often referred to as averaging down in stock trading. Doubling risk after a loss is an absolutely horrendous strategy that will always fail at some point, so it is logical for a prop firm to prohibit this. In fact, we might even call it revenge trading.

But if you are prohibiting doubling down or increasing risk when a trader loses, why would you also prohibit them from reducing risk? Seems counterintuitive, unless your purpose is to trap a trader to terminate their account.

They ban traders and refuse to pay out, even if you merely scale into positions, which means entering a new position while the first one is still open, even if you are in profit. This behavior is unacceptable for a prop fund!

Drawdown Deception

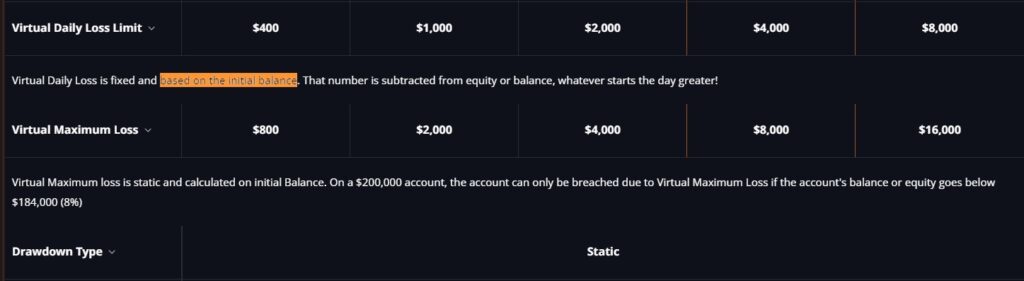

On their home page, describing their challenges, SmartProp Trader states that their drawdown is static and based on initial balance, as you will see in the following screenshot:

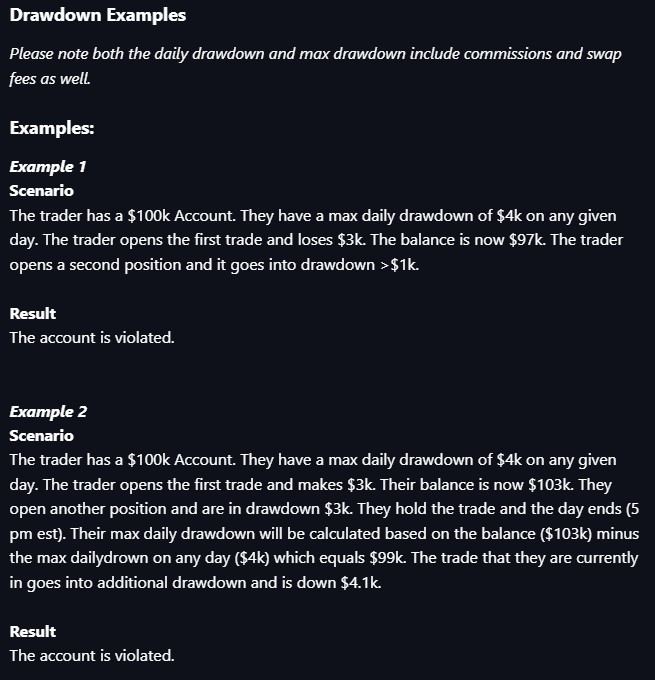

Based on this statement, you might expect that a trailing drawdown wouldn’t be a concern. However, you might want to read the fine print. SmartProp Trader apparently isn’t smart enough to understand the meaning of ‘static.’

In their FAQ, we find this explanation along with examples of their “static drawdown,” which is so ‘static’ that it shapeshifts. Clearly, the examples demonstrate that the drawdown is not static but dynamic, trailing the account as profit is made. How could an account with $100k be terminated at $99k if the drawdown is supposedly static? This is utterly absurd!

Copy and Paste Prop Fund

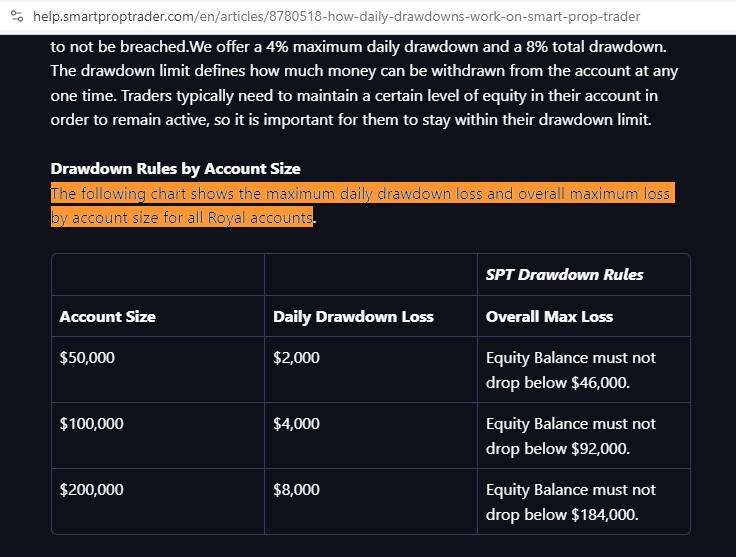

As we dug a little deeper we found a plausible explanation for why SmartProp Trader has inconsistencies in what they claim and what they actually offer. Take a look at this screenshot from SmartProp Trader:

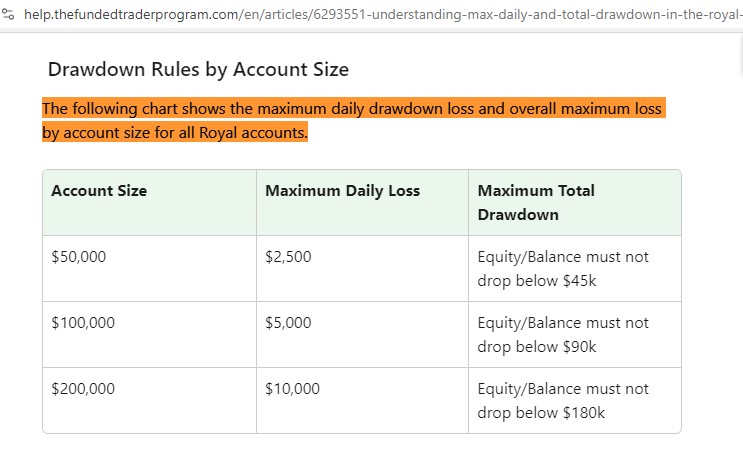

Wait a second, SmartProp Trader doesn’t have a “Royal account,” do they? Nope, but The Funded Trader does, and they just copied TFT’s FAQ as you can see in the following screenshot:

As you can see, they have copied TFT verbatim, forgetting to change the name of the challenge. This is, at best, sloppy, and at worst, it amounts to deceptive advertising that could lead a trader to lose an account.

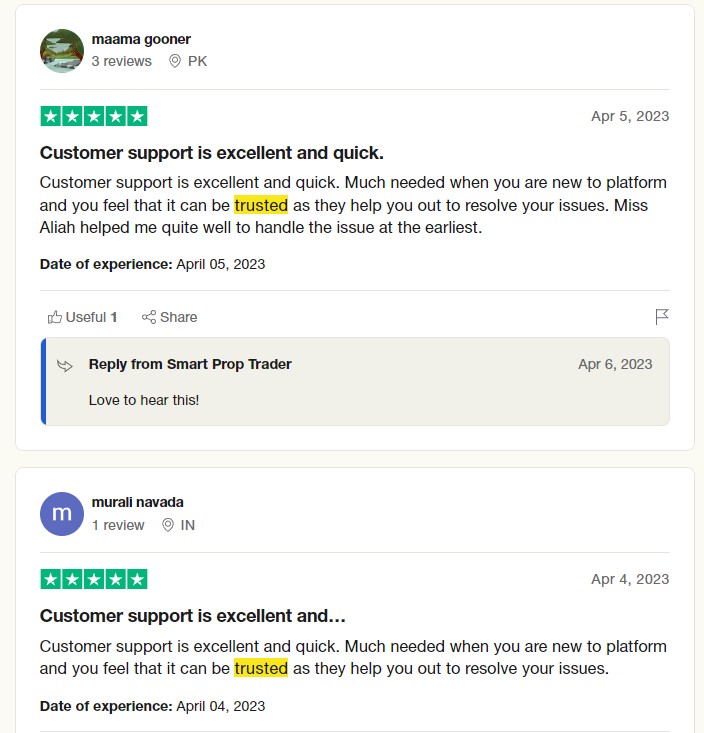

Fake Reviews

If you’re going to pay for fake reviews, you might want to be a bit more creative. Many of their reviews are identical, with only a few words added or changed.

The Smart Prop Trading Challenge

Their challenge is pretty much a clone copy of FTMO. If you aren’t in the USA, we highly suggest you choose FTMO instead of SmartProp Trader.

| $10K Account | Challenge Step 1 | Step 2 – Verification | Funded Trader |

| Time to Complete | Unlimited | Unlimited | Unlimited |

| Min. Trading Days to Pass | None | None | n/a |

| Max. Daily Loss** | $400 (4%) | $400 (4%) | $400 (4%) |

| Max. Total Loss | $800 (8%) | $800 (8%) | $800 (8%) |

| Drawdown Type | Dynamic*** | Dynamic*** | Dynamic*** |

| Profit Requirement | $700 (7%) | $500 (5%) | none |

| Cost of Challenge | $97 | Free | Refunded* |

* To qualify for a refund, you must not only pass both steps of the challenge but also become eligible for a profit split. Your challenge fee will be refunded when you request your first withdrawal.

** The maximum daily loss is a rule that if breached results in disqualification of your challenge. In contrast, The 5ers‘ daily pause (Bootcamp and Hyper Funding) only temporarily disables trading for that day without disqualifying your account. Just another reason to choose a trusted Prop Firm.

*** As described above, the drawdown is dynamic, even though SmartProp Trader claims it is static.

Fees and Spreads

SmartProp Trader uses Eightcap as their broker. We have conducted tests on Eightcap using our own proprietary tool that evaluates the consistency of spreads, observing the lowest and highest spreads for each instrument. Presented here are the spreads during normal trading hours and also spreads observed between 3-5 PM EST. This analysis does not take into account extreme volatility, but rather reflects a typical trading day.

Many new prop funds, backed by Eightcap, are cropping up, but what few realize is that the Eightcap backend for prop firms features a fully customizable suite of tools to control market conditions. They have the ability to adjust slippage based on the lot size traded, apply slippage only in phase two or the live account, among other things. Therefore we discourage the use of prop funds that use Eightcap. However, since almost all prop funds using Eightcap have questionable practices, this in itself is a red flag. So their spreads may not look bad on paper but since they control slippage they always hold the winning hand.

Spreads (for Eightcap)

Forex Lowest Volatility Spreads:

| INSTRUMENT | Average Spread | Lowest Spread | Highest Spread |

| EURUSD | 0.00003 | 0 | 0.00011 |

| GBPUSD | 0.00005 | 0.00001 | 0.00012 |

| USDCHF | 0.00009 | 0.00005 | 0.00016 |

| USDJPY | 0.009 | 0.001 | 0.014 |

| EURJPY | 0.008 | 0.005 | 0.009 |

| GBPJPY | 0.009 | 0.007 | 0.012 |

Forex from 4-6PM Spreads

| INSTRUMENT | Average Spread | Lowest Spread | Highest Spread |

| EURUSD | 0.00023 | 0 | 0.00071 |

| GBPUSD | 0.00060 | 0.00005 | 0.00222 |

| USDCHF | 0.00029 | 0.00010 | 0.00115 |

| USDJPY | 0.033 | 0.007 | 0.256 |

| EURJPY | 0.061 | 0.007 | 0.297 |

| GBPJPY | 0.110 | 0.012 | 0.476 |

Crypto, Metals, Indices:

| INSTRUMENT | Average Spread | Lowest Spread | Highest Spread |

| XAGUSD | 0.023 | 0.021 | 0.025 |

| XAUUSD | 0.12 | 0.12 | 0.13 |

| UK Oil | 0.03 | 0.03 | 0.04 |

| US Oil | 0.03 | 0.03 | 0.03 |

| NAS 100 | 1.40 | 1.40 | 1.40 |

| S&P500 | 0.53 | 0.53 | 0.53 |

| UK 100 | 1.20 | 1.20 | 1.20 |

| US 30 | 1.60 | 1.60 | 1.60 |

| JPN 225 | 7 | 7 | 7 |

| BTCUSD | 35.50 | 16.84 | 39.20 |

| ETHUSD | 2.40 | 2.25 | 2.85 |

| DAX30 | 3.37 | 4.20 | 3.20 |

Commissions

Smart Prop Trader charges $7 per lot for Forex trading, although their website falsely states it is $6. Why is it not surprising that is inaccurate?

Commissions on Crypto, Indices, and Commodities are all $0 per lot.

Prop Fund Fees

Smart Prop Trader does not charge any fees apart from the evaluation/challenge cost. Any fees associated with withdrawing profits would be related to Crypto fees.

Verdict

Overall, Smart Prop Trader falls short on every level. Their spreads are unimpressive when compared to competitors like FTMO or The 5ers, and slippage can be very unpredictable. The inconsistencies in describing their own rules, coupled with egregious exaggeration of rules to excuse refusing payouts to traders, combined with their sloppy website and low trustworthiness, make Smart Prop Trader an exceedingly dumb choice.

Smart Prop Trader is adjudged as a prop firm fraught with risks, lacking any discernible advantages or benefits when compared to other firms in the industry.